The Federal Reserve has been raising interest rates recently to counter the higher inflation the economy has seen over the past few years. How does this impact divorcing couples? The impact that most comes to mind is refinancing the marital home.

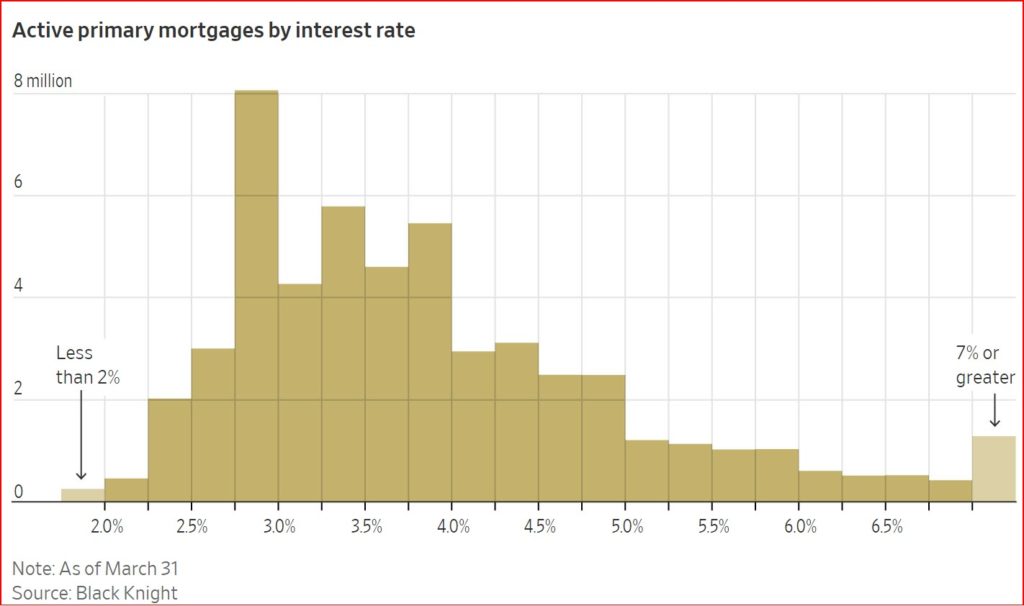

One of the options couples have when divorcing is to “sell” the marital home to one of the spouses. When that happens, usually title is transferred to the receiving (“buying”) spouse who also refinances the mortgage into their name. That clears responsibility for the home or the mortgage from the “selling” spouse. Many homeowners have extremely low mortgage interest rates as they have been historically low for many years. As the Federal Reserve has raised interest rates, so have the rates on mortgages. Many people have mortgages in the 3-4% range and the current 30-year mortgage rate is over 7%. The graph below is from the Wall Street Journal:

How does this translate into affordability? Let’s look at a $400,000, 30-year fixed rate mortgage — not uncommon here in NJ — and let’s say the couple had a 3.5% mortgage. The monthly payment on that would be $1,796. Now the couple divorces and one spouse keeps the house. That spouse refinances into a $400,000 30-year fixed rate mortgage at 7%. The monthly payment on this new mortgage is $2,661. That’s an increase of $865 (or 48% more on each payment). And now instead of two incomes covering that mortgage payment, only one is. The other spouse needs housing too — with the associated costs.

I have my clients develop post-divorce budgets to see what they can afford after the divorce. Housing is usually one of the larger costs any person has. It may make staying in the marital home more difficult after a divorce.

Some people suggest just keeping the current mortgage and the departing spouse on the title. That presents a risk for the departing spouse. What happens if the spouse staying in the house doesn’t make a mortgage payment? What happens if the house needs a major repair and the resident spouse doesn’t make the repairs? The departing spouse can be liable for all of this. One of the points of divorce is to separate finances and risks. Keeping the departing spouse tied to the marital home after the divorce does not accomplish this. (Yes, you can write up an agreement saying that the resident spouse is responsible for everything, but the bank doesn’t care about your agreement.)

Higher interest rates and its impact on divorcing couples is something to keep in mind and something we have not seen in decades as a significant concern.

To mediate your divorce and discuss these issues, please contact me.